A 10K A Day Medium

The mileage Uber tracks for you. These days, the Uber driver app attempts to track all the miles you drive while you have the app open: your online miles. These can include the miles you drove on the way to a pickup, with a passenger — or UberEats delivery — in the car, and while waiting for your next trip. (This hasn't always been the.

What Can Drivers Do if They to Track Their Mileage?

In the past, we've calculated that a full time driver in LA will log around 48,360 miles a year. If Uber only captures 45.6% (28.7/62.9) of the total miles you drive (i.e. when you have a paying passenger) compared to Lyft capturing about 64.5% (40.61/62.9) of the eligible miles we get the following at the end of the year:

49 HQ Images Mileage Tracker App For Truckers Best 10 Auto Mileage Tracker Apps Last Updated

ADMIN MOD. Exaggerating Mileage on Tax Form Without Any Spreadsheets or Proof. Uber and Lyft have me at about 20k. I didn't track my mileage manually, but I don't think they missed more then 2-3 k. I put it at 29k. That saved me 500$. Obviously the form hasn't been filed yet.

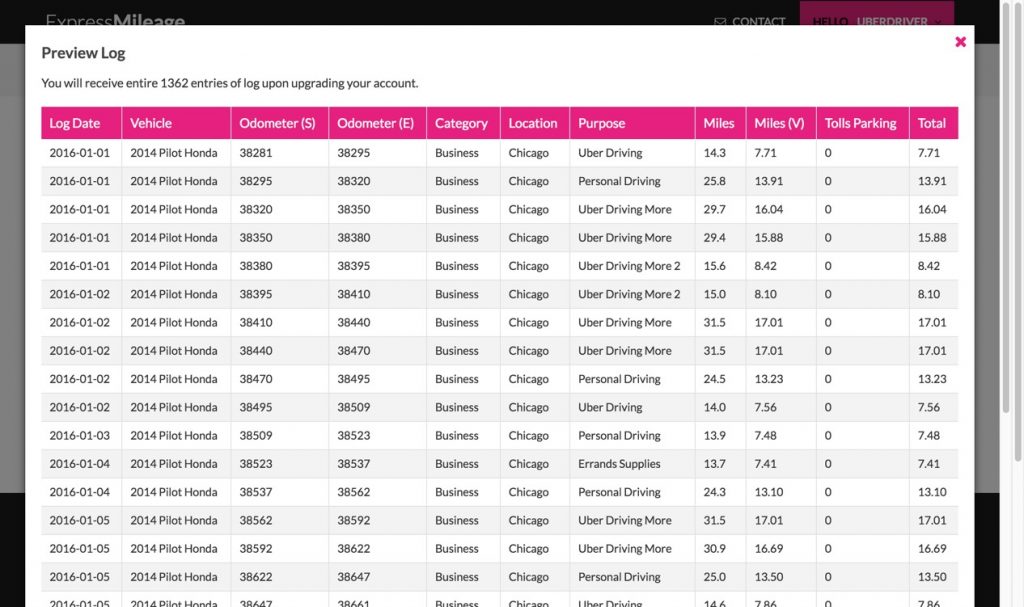

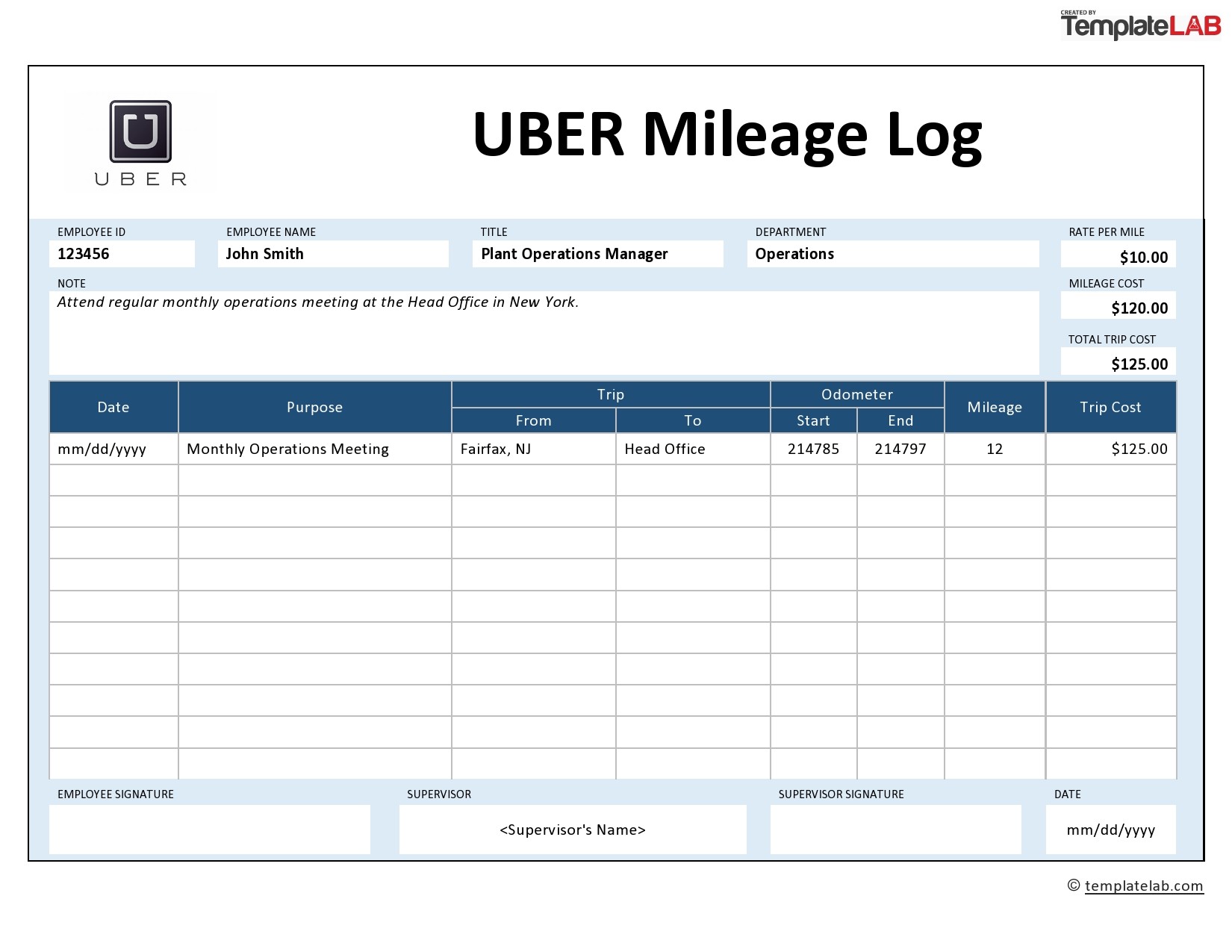

How to Create an UBER Mileage Log ExpressMileage

Uber has no obligation to keep track of your miles so I doubt if you will ever get any resolution. Forget Uber's mileage records, stop wasting time emailing them and just keep your own mileage log with an app or pen and paper. Reactions: goneubering and DocT. Save Share. Like. kcdrvr15.

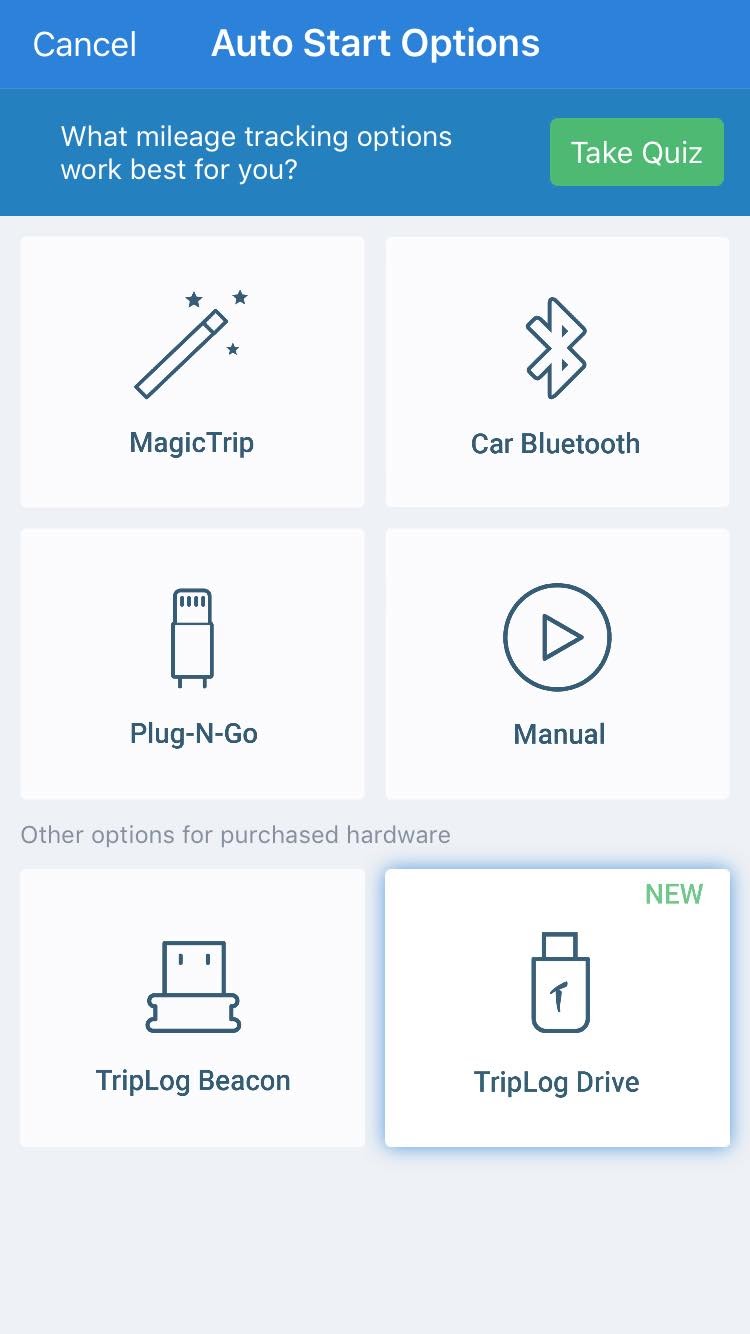

Triplog Mileage Review Mileage Tracker for Uber Drivers

1) Start with your trip logs. Uber will track your on-trip mileage for you. This includes your mileage when you have a passenger in the car, but not your mileage when you are driving to the passenger, or driving between trips to find places where you're likely to be matched with a passenger. Your on-trip mileage serves as the minimum mileage.

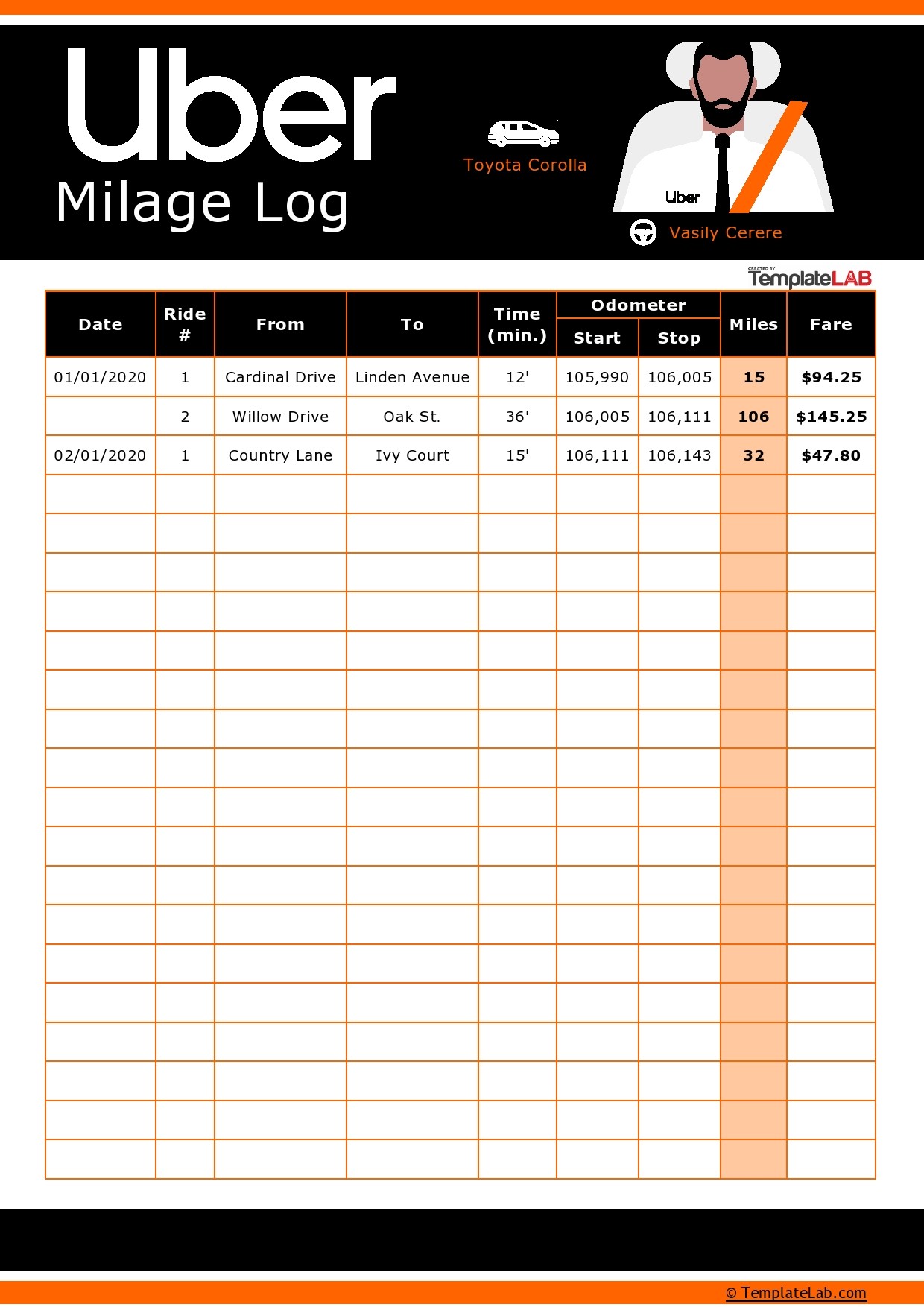

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Instead of having to keep track of dozens of expenses, you only have to track the number of miles you drive for business. To receive your deduction, you just multiply the number of business miles you drove by the IRS standard mileage rate. For the 2020 tax year, the business mileage rate is 57.5 cents per mile.

The 5 Best Mileage Tracker Apps in 2022 Bench Accounting

To find the amount of your deduction under the actual expenses method, you first have to figure out how much of all the driving you did that year was for work. 12,000 business miles / 18,000 total miles = 66.7%. Next, you multiply that percentage by your total car expenses: $16,805 expenses x 66.7% = $11,203.

Triplog Mileage Review Mileage Tracker for Uber Drivers

Follow My Ride. A feature to let loved ones know where you are. You can share your trip status and location on the map with friends and family, all right from the app, so someone you trust always knows where you are. You can start and stop sharing anytime.

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

The mileage reported on your Tax Summary is the total online miles including all the miles you drove waiting for a trip, en-route to a rider, and on a trip. To determine whether your mileage is deductible, we recommend contacting an independent tax professional for any tax questions you may have, as Uber does not provide tax advice.

Need to Track Your Mileage and Expenses? Here Are 7 Free Apps for That Mileage tracker app

And why is it important to track your miles? So you can correctly claim the standard mileage deduction and maximize your tax savings—legally!. If you drive for Uber & Lyft or delivery apps, the standard mileage deduction is the #1 way to significantly lower your tax bill.For 2023, you can deduct 65.5 cents per mile.

6 Best Uber Eats Mileage Tracker Apps to Log Your Deliveries

How to Track Your Miles As a Delivery Contractor with Doordash Grubhub Uber Eats Instacart etc. Every mile that you track as a contractor delivering for Doordash, Uber Eats, Grubhub, Instacart, Lyft etc, is saves about 14 cents on your taxes. When you drive thousands of miles, that adds up. Prep Time 1 minute.

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

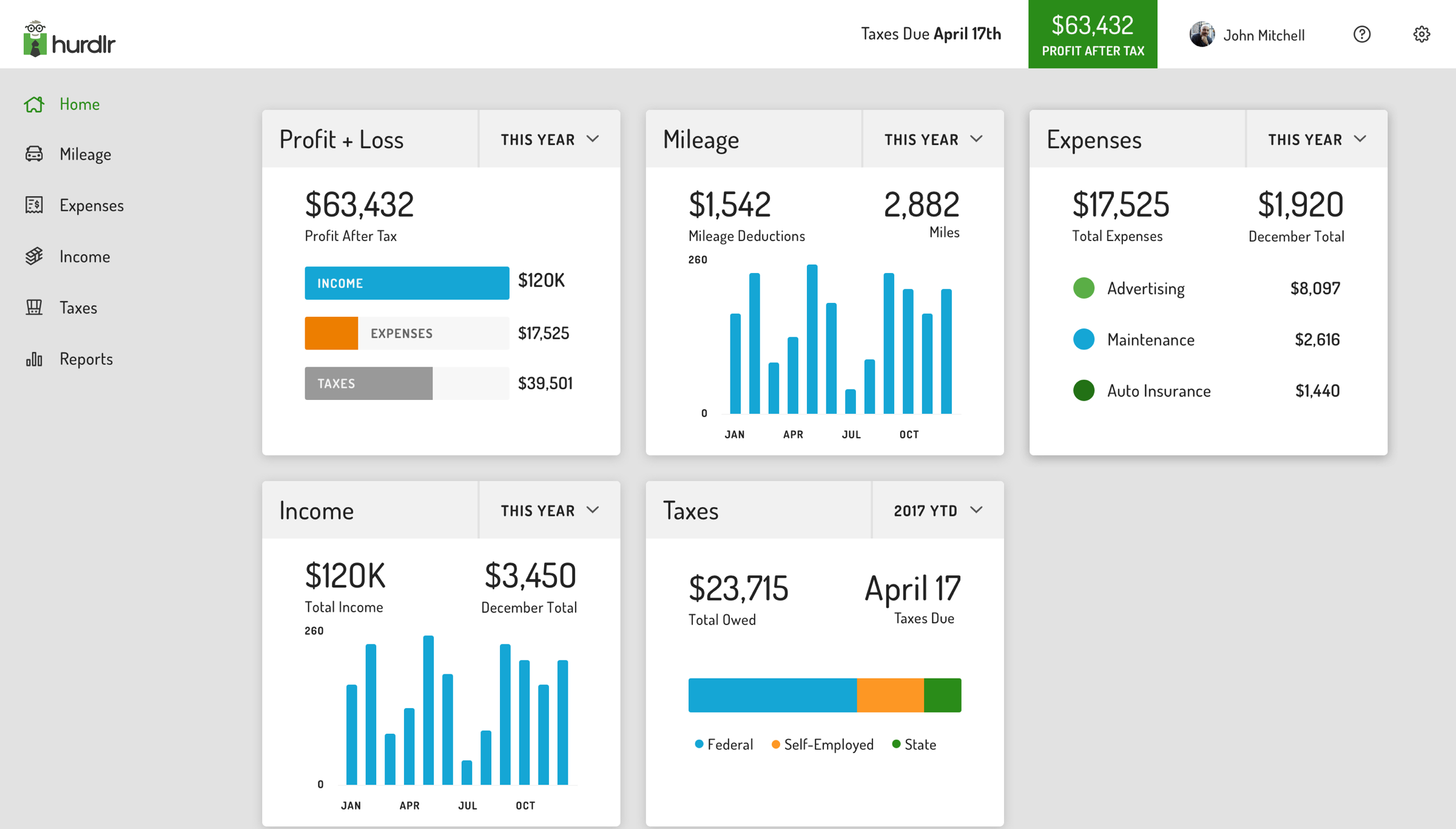

14. MileBug. 1. Hurdlr. If your main goal in tracking mileage is easier tax return filing, Hurdlr was built with this purpose in mind. Not only does it auto-track mileage and expenses, but it also offers real-time views of earnings and potential tax deductions.

Does Doordash Track Miles? How Mileage Tracking Works For Dashers

Yes. The IRS lets you deduct 53.5 cents per business mile for 2017. All of those miles are considered business miles when you drive for Uber. While 53.5 cents may not seem like a lot, it can quickly add up. At the end of the year, that can lead to a deduction worth thousands of dollars. Remember, the more deductions you have, the lower your.

Triplog Mileage Review Mileage Tracker for Uber Drivers

Yes. You can claim online miles as deduction as long as it's Uber related. Like driving to the airport for an airport run or driving around looking for a trip. Just don't stop to pickup flowers or dry cleaning and claim it as business/work related. Truckin_18.

Uber eats taxes calculator KellyannOcean

A full-time driver, clocking about 25,000 miles in six months, would receive a deduction of $15,625. And that's just for half of the year. There is no way any driver would want to miss out on such a sizable Lyft, DoorDash, or Uber tax deduction! The point is clear: you definitely want to track your mileage. But, for the sake of argument, let.

Uber Eats Mileage Tracker Printable Log Book Planner Taxes Etsy Finland

Correct. Even during pickup and rider cancels, it still get recorded for the miles. pakrat1967 • 3 yr. ago. Uber does track miles and the info will be included in yearly tax docs. The problem is it may not be accurate. For example, Uber may only count miles while on a trip. Even though you can actually claim any miles when online.